Table Of Contents

What Is A 401k Calculator?

A 401k calculator allows individuals to calculate the balance that the 401K retirement plan will yield when withdrawn. The calculator works on the regular formula that keeps into consideration all the deposits and other figures to be added or deducted to compute the total amount that matures.

A 401(k) is a type of account where individuals deposit the amount pre-tax and defer the payment of taxes until withdrawing the same at the time of retirement. 401k calculators can calculate that maturity amount subject to prescribed limits per authority rules.

401k Calculator Explained

A 401K calculator allows individuals to use information as per the 401k retirement plan agreement and then calculate the amount they are eligible to receive at retirement in exchange for the deposits that they have made over time.

401(k) is a retirement plan wherein the individual deposits money pre-tax. It defers the taxes until retirement. Further, individuals take a deduction for contributing the same and are then liable for taxes on the entire amount at the time of retirement. A calculator, however, functions accurately only when the data put in for calculations is accurate. In case, the information or input asked for in the calculator is incorrect or does not satisfy the criteria, the result obtained is unreliable and incorrect. Hence, using correct data or at least correct assumption is important.

An online calculator is based on the common formula that one uses for a particular calculation. The formula on which the 401k calculator has been built is as below:

Periodical 401(k) is made, then calculation:

O * (1+i)F*n + I * ((1+i)F*n – 1 / i )

In case the investment is made at the beginning of the period

O * (1+i)F*n + I * ((1+i)F*n – 1) * (1+i) / i )

Wherein,

- O is the starting account balance

- I is the periodically fixed amount invested at regular intervals

- i is the rate of interest

- F is the frequency of interest is paid

- n is the number of periods for which 401(k) shall be made.

401(k), as stated above, is a type of retirement plan wherein the individuals contribute the amount pre-tax and defer the payment of taxes until retirement. At the time of retirement, when they withdraw, they bear taxes on the entire amount. However, certain limits have to be adhered to. One can deposit up to $19,000 per year for 2019. Further, $6,000 is the additional limit that can be deposited if the individual is aging 50 years or more as of 2019. Further, if the individuals are salaried, employers can match their contribution amount, which could be from 0% to 100% of their contribution and not more than 6% of the annual salary. This is a good retirement plan for most individuals.

Assumptions

At times, individuals do not have the input data readily available, they can have an estimated figure to be used for a considerate result.

If the above scenario is true and individuals do not have accurate input information to be used for calculation, here are a few assumptions that can help them:

- According to retirement experts, it has been observed that the regular deposit that individuals make into their 401k account is approximately 10% of their salary. Thus, the contribution amount (here, I) should be 10% of the salary one gets.

- The next is the starting balance when the account activates. Here, it is denoted with O. This is normally known to individuals.

- The “i” reflects the annual rate of return for the investments, which is assumed to be up to 9%.

- F is the number of times interest is paid

- N is the period in which individuals invest.

How to Calculate Using It?

One needs to follow a series of steps to calculate the maturity amount for the 401(k) account using the calculator Let us have a quick look at the steps:

Step #1 – Determine the account's initial balance, if any, and also, a fixed periodical amount will be invested in the 401(k).

Step #2 – Figure out the rate of interest that would be earned on the 401(k).

Step #3 – Now, determine the duration left from the current age until retirement.

Step #4 – Divide the interest rate by the number of periods the interest or the 401(k) income is paid. For example, if the rate paid is 9% and compounds annually, the interest rate would be 9%/1, which is 9.00%.

Step #5 – Determine whether the contributions are made at the start or the end of the period.

Step #6 – Determine whether an employer is contributing to match the individual's contribution. That figure plus the value in step 1 will be the total contribution in the 401(k) account.

Step #7 – Now, use the formula discussed above for calculating the maturity amount of the 401(k), which is made at regular intervals.

Step #8 – The resultant figure will be the maturity amount, including the 401(k) income plus the amount contributed.

Step #9 – There would be tax liability at the time of retirement for the entire amount since the contributions are pre-tax, and deductions are taken for the contributed amount.

Examples

Let us consider the following examples to understand how the 401(k) calculator is used to figure out deposits and returns.

Example #1

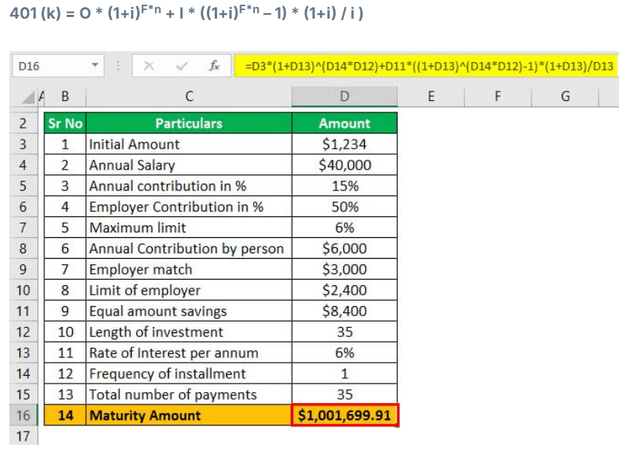

Mr. M is working in a multinational firm, and he has been investing in a 401(k) account and has accumulated $1,234, and he earns $40,000 early, and he wants to contribute 15% of his annual salary. Further, the employer also contributes 50% of his contribution and limits the same to 6% of the annual salary. Mr. M wants to invest for the next 35 years. The rate of interest that he will earn will be 6% per annum, which will be compounded annually. The contribution will be made at the start of the year.

You must calculate the amount accumulated at maturity based on the given information.

Solution:

We are given below the details:

- O = $1,234

- I = Fixed amount deposited periodically which would be $40,000 x 15% which is $6,000 subject to $19,000 and employer’s contribution will be 50% of 6,000 which is $3,000 subject to 6% of salary which is $40,000 x 6% which is $2,400 and therefore total contribution will be $6,000 + $2,400 which is $8,400.

- i = Rate of interest, which is 6.00% and is compounded annually

- F = Frequency which is annually here; hence it will be 1

- n = number of years the 401(k) proposed will be 35 years.

Now, we can use the below formula to calculate the maturity amount.

- = 1,234 * (1 + 6.00% )1 * 35 + 8,400 * ((1+6.00%)1 * 35 – 1 * (1+6%)) / 6%

- = 1,001,699.91

When he withdraws the amount at the time of retirement, he will be liable for tax on the entire amount since the contributions are made pre-tax and deductions have been taken.

Example #2

Mrs. Seema has thought of opening 401(k) accounts for her retirement plan. She will be depositing $5,000 yearly, and her employer has also agreed to deposit 30% of her contribution subject to 5% of her annual salary. She has been drawing a salary of $50,000 per annum. The rate of interest will be 7% per annum compounded annually. She has 20 years left in her retirement. These contributions will be made at the beginning of the year.

You are required to calculate the maturity amount based on the given information.

Solution:

We are given below the details:

- O = $0

- I = Fixed amount deposited periodically which would be $5,000 subject to $19,000 and employer’s contribution will be 30% of 5,000 which is $1,500 subject to 5% of salary which is $50,000 x 5% which is $2,500 and therefore total contribution will be $5,000 + $1,500 which is $6,500

- i = Rate of interest, which is 7.00% and is compounded annually

- F = Frequency, which is annually here; hence it will be 1.

- n = number of years the 401(k) proposed will be 20 years.

Now, we can use the below formula to calculate the maturity amount.

- = 0 * ( 1 + 7.00% )1 * 20 + 6,500 * ((1+7%)1*20 – 1 * (1+7%) / 7%

- = 285,123.65

When he withdraws the amount at the time of retirement, he will be liable for tax on the entire amount since the contributions are made pre-tax and deductions have been taken.