Table Of Contents

What Is The 3-Statement Model?

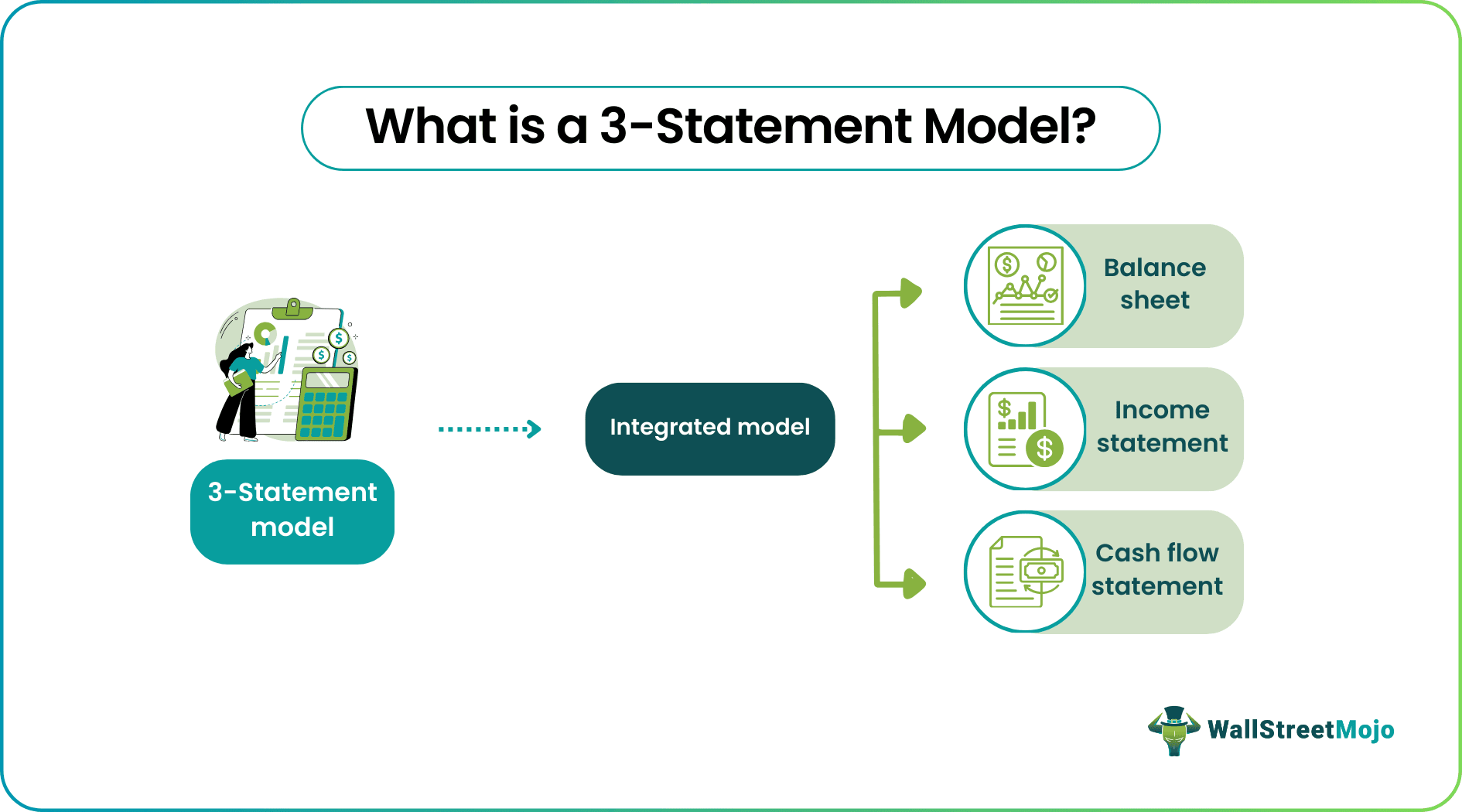

A 3-statement model is a type of financial modeling which connects three key financial statements like the income statement, balance sheet and cash flow statement and prepares a dynamically connected one single financial model which is used as the base of complex financial models like leverage buyout, discounted cash flow, merger models and other financial models.

This model ensures the financial transactional details are observed and studied accurately. Considering one of the statements generated by a firm might not help the management and stakeholders learn about the actual position of that organization. However, studying the three statements together offers better picture.

Key Takeaways

- A 3-statement model refers to a type of financial model that links a company’s three core financial statements. It can help get a clear picture of an organization’s financial position.

- A 3-statement financial model forms the basis of a discounted cash flow model. The former serves as the source for the input data utilized in the latter.

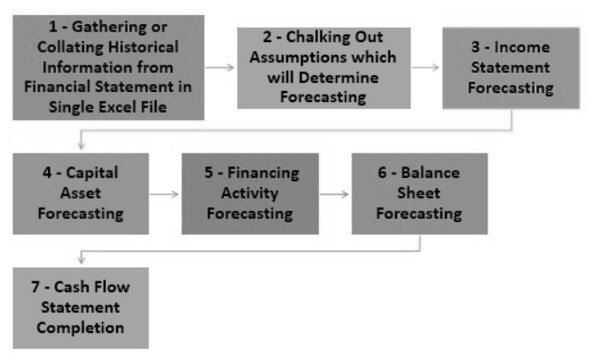

- 3-Statement modeling involves a series of steps, for example, accumulating historical data from three financial statements, income statement forecasting, and capital asset forecasting.

- One can use a simple 3-statement model available online to build an integrated financial model that can improve decision-making.

3-Statement Model Explained

The 3-statement model is very dynamic modeling to integrate all the key financial statements into a single excel file. This makes the job more organized and more comfortable and reduces the chances of human error. It is a very crucial model used for forecasting modules. It is also very user friendly, and because one uses excel to build it, this is easily understandable by all.

A 3 statement model is a complex financial model which combines the three critical financial statements like income statement, balance sheet, and cash flow statement. It integrates all the three into a single financial model. This model acts as the base for further critical models like DCF valuation, merger and acquisition models, etc. It is also used for scenario and sensitivity analysis. The leading utility of these models is that in a single excel file, we can capture the fundamentals of three statements simultaneously. There is less risk of wrong linkages of formulas. It looks more organized when the entire thing is presented in a single Excel file and rather than using three different models. It also provides an enhanced scope of consolidation of multi-business organizations.

If you want to develop a practical understanding of a 3-statement model and related topics, you can consider checking out this Valuation Certification Course. The program delves into this topic further with the help of examples.

How To Create A 3-Statement Model?

A 3-statement model requires several steps to finally integrate all the three financial statements into a single model. The steps required are as follows:

Step 1 - Gathering or Collating Historical Information from Financial Statement in Single Excel File

In this step, financial information is obtained from the company website or their press release, and these are considered historical information. These data are either downloaded to a single excel file or copy-pasted into it. After doing this, the excel file needs to be formatted a bit to make the data readable and understandable.

Step 2 - Chalking Out Assumptions which will Determine Forecasting

Now once we have the historical data in our excel file, we can implement some formulas to calculate or evaluate the historical performance of the company. Metrics such as margins, growth of revenues, capital expenditures, and working capital calculation can be considered as the following.

Step 3 - Income Statement Forecasting

After all the assumptions taken into consideration, it is now the stage to forecast the income statement. It all begins from the revenue and drills now further to the calculation of the EBITDA. In this stage, we also require support scheduling methods for financing activity processes and capital assets.

Step 4 - Capital Asset Forecasting

Here the forecast is made on aspects like plant and machinery, property, and only after this, one can end the income statement part of the model. Here the closing balance of the last period is considered, and then the capital expenditure is added, or depreciation deducted to arrive at the final closing balance.

Step 5 - Financing Activity Forecasting

Here we need to set up a schedule of debt plans to arrive at the interest expense on the income statement. Here too, we consider the last period’s closing balance and then add to this any increase or decrease in the value of the principal to conclude the closing balance.

Step 6 - Balance Sheet Forecasting

Here we consider the balance sheet information and working capital elements are forecasted here, taking into consideration assumptions like average payable days, average receivables, inventory turns, etc. Capital assets come here from the schedule we mentioned above. Here the cash balance is not forecasted or completed, which is the last step of the 3-statement model.

Step 7 - Cash Flow Statement Completion

The last stage of three-statement modeling is the completion of the cash flow statement. This statement requires a simple linking of the earlier items, calculated to arrive at the cash balance. There are three main sections: cash from operations, cash from investing activity, and cash from financing activity. Thus, by linking these three to the other statements, we arrive at the final cash in hand/bank balance.

If individuals have confusion regarding the process, they can take the help of a simple 3-statement model template available online. It can help them integrate a company’s income statement, balance sheet, and cash flow effectively.

Moreover, one can improve their practical knowledge of this concept by enrolling in the 2-Day Financial Modeling Bootcamp. This online session guided by an industry-expert aims to help students and professionals understand its real-world application via a 3-statement model case study.

Periodicity In A 3-Statement Model

Periodicity is the different periods one uses to present the data in the financial model. Individuals can select quarterly, weekly, monthly, or annual periods. The period selected will determine how a person is going to utilize the model. Let us look at the different types of such a model based on periodicity.

- Weekly Models: The usage of these models is common in bankruptcy cases. The most popular model out of the weekly models is the thirteen-week cash flow or TWCF model.

- Monthly Models: These models are common in the case of project finance and restructurings, where liquidity monitoring on a month-to-month basis is vital.

- Quarterly Models: Such models are commonly used in financial planning & analysis, mergers & acquisitions modeling, and equity research.

- Annual Models: The usage of an annual model is common when driving a discounted cash flow model valuation. The reason behind this is that a DCF model requires explicit forecasts of a minimum of 5 years prior to making the terminal value

Examples

Let us consider the following instances to understand the 3-statement model better:

Example #1

Suppose a firm ABC generates a balance sheet, income statement, and cash flow statement, but while assessing the financial position, it prefers to go through the balance sheet more often and the income statement. In the current year, it adopted the same approach. However, the company presented all three statements to the investors.

As per the observation, the firm found that it was on the right track, but when the investors had a look at the three statements, they had a different opinion. While the latter observed that the balance sheet and income statement were okay to consider investing in the firm, their mind changed when they studied the cash flow statement, which reflected the frequent increase in the cash outflow, which sometimes led to an adverse imbalance in the cash remains of the company.

This observation led to the loss of investor interest in the company. This incident changed the approach of the firm ABC as well. Thereafter, they adopted 3-statement model, whereby they studied all three financial statements thoroughly to identify loopholes and work on them. The example above shows the importance of this type of modeling.

Example #2

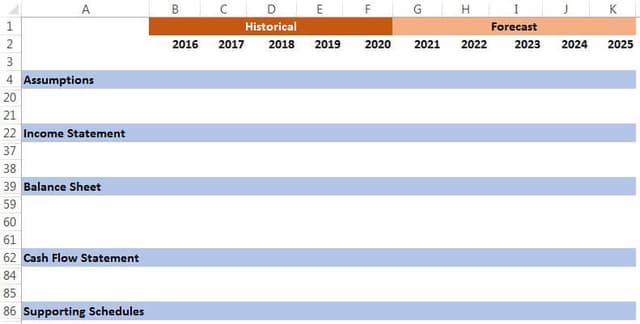

A simple 3-statement template model based on Excel is now attached. Here we have included historical data till 2020 and forecasted based on the same till 2025. Three key financial statements have been used: profit and loss statement, balance sheet, and cash flow statement. In the end, we have also attached a plan of schedule, and at the beginning of the 3-statement model template, there are the assumptions that have been considered.

Approaches

There are five steps to build a 3-statement model. Assumptions are essential because we need to assume many factors like growth rate, interest rate, etc.

Let us have a look at the assumptions that exist for these models:

- The first and foremost important approach is our assumptions, which means how the business will drive itself in the forecasted period.

- Next comes the income statement, which is a summary of profit and loss, and thus, based on the historical data, the future is predicted.

- After this, we have the balance sheet, which explains the position of the company at a particular point in time. Same as the profit and loss statement here too based on historical data, we forecast the future period.

- After this, from data points in the above two statements, we build our cash flow statement, which is the ultimate goal of our 3-statement modeling. Here few data gets populated from profit and loss statements and balance sheets. Thus, we find all three statements are linked to one another. It shows the different levels of cash from operations, investing activity, and financing activity and finally arrives as a closing cash balance or net cash balance.

- The last part of the three-statement model is the supporting schedules, which help calculate the depreciation or interest and other such factors.

3-Statement Model vs. DCF

Discounted Cash Flow (DCF) model and 3-statement model are two types of financial models that are used to help firms assess their financial progress with respect to the transactions undertaken over a period. The difference between these two models, however, have been listed below for firms to know which model to adopt for assessing their financial position and progress:

- The 3-statement model is the foundation model for the other models developed. DCF model is one of them.

- Though the latter finds its base from the former, the DCF modeling is exercised independently. Only the input data to be used for the modeling is acquired from the 3-statement model, comprising the balance sheet, income statement, and cash flow statement.