Table Of Contents

What Is The 2020 Stock Market Crash?

The 2020 stock market crash refers to a significant decline in global stock markets that occurred in early 2020, primarily as a result of the economic impact of the COVID-19 pandemic. As the pandemic spread globally and led to lockdowns, travel restrictions, and business closures, investors became increasingly worried about the economic consequences, leading to a widespread sell-off of stocks.

The crash was notable for its speed and severity. Major stock indices, such as the Dow Jones Industrial Average (DJIA) and the S&P 500, experienced rapid declines, with some days seeing the most significant single-day point drops in history. Governments and central banks worldwide responded with economic stimulus packages, monetary easing, and other measures to mitigate the economic impact and stabilize the markets.

Key Takeaways

- The 2020 stock market crash occurred in the early 2020s and highlighted the vulnerability of financial markets to unforeseen events. The rapid spread of COVID-19 and its economic implications demonstrated that markets can experience significant volatility and downturns due to unexpected shocks.

- The crash emphasized the importance of risk management in investment strategies. Diversification across asset classes and sectors and maintaining a long-term perspective can help mitigate the impact of market downturns and reduce exposure to individual stock risks.

- The crash underscored the need for individuals and businesses to have financial resilience. Building emergency funds, maintaining manageable debt levels, and having contingency plans can help weather economic downturns and mitigate the impact of market crashes.

2020 Stock Market Crash Explained

The 2020 stock market crash refers to a sharp and sudden decline in global stock markets during the first quarter of 2020. It resulted from a confluence of factors, primarily the COVID-19 pandemic. However, it exposed several vulnerabilities and shortcomings within the financial system and raised questions about the effectiveness of government interventions.

- The fragility of the financial system: The severity and speed of the market crash exposed the fragility of the financial system. It highlighted the interconnectedness of global markets and the potential for a rapid contagion of fear and panic. This raised concerns about the stability of the financial system and the effectiveness of risk management strategies employed by financial institutions.

- Overreliance on quantitative easing: In response to the crisis, central banks worldwide implemented massive monetary easing measures, including lowering interest rates and increasing asset purchases through quantitative easing (QE). While these measures provided short-term relief and liquidity, they also fueled concerns about the long-term consequences, such as asset price inflation, the devaluation of currencies, and the potential for future market distortions.

- Inequality exacerbated: The stock market crash highlighted the growing wealth inequality within society. As stock prices tumbled, the wealthiest individuals and institutional investors were better positioned to weather the storm or take advantage of buying opportunities. Conversely, smaller investors and those with limited financial resources faced significant losses, exacerbating the wealth gap.

- Limited effectiveness of government interventions: While governments and central banks implemented economic stimulus packages and monetary easing, questions remain about the efficacy of these interventions. The benefits of these measures were unevenly distributed, and many argued that the assistance provided to corporations and financial institutions outweighed the support offered to individuals and small businesses.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Causes

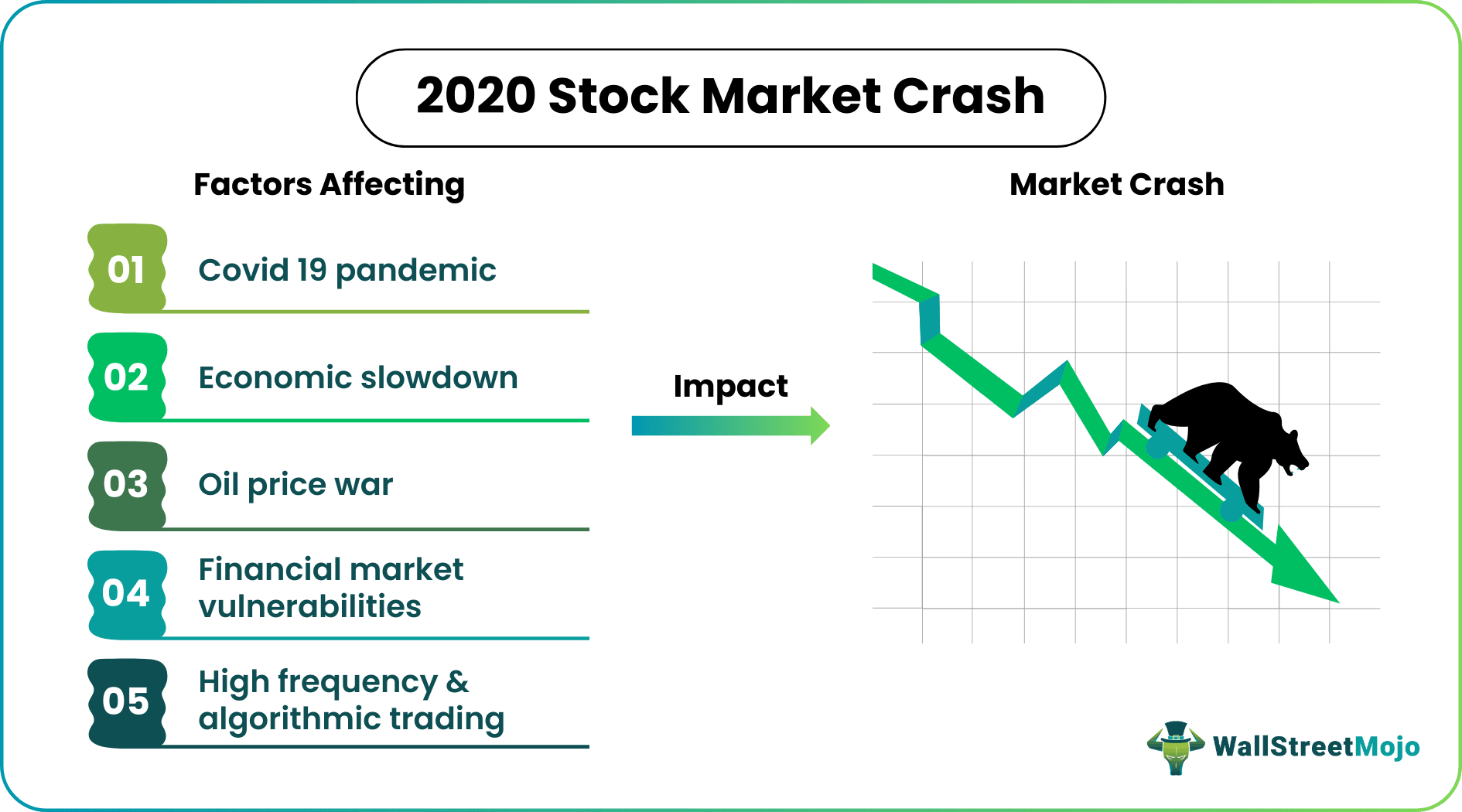

Some fundamental causes of the 2020 stock market crash are as follows:

- COVID-19 pandemic: The rapid spread of the coronavirus across the globe created significant uncertainty and fear among investors. As countries imposed lockdowns, travel restrictions, and business closures to contain the virus, concerns arose about the resulting economic impact. Investors worried about reduced consumer spending, disruptions to supply chains, and the potential for a global recession.

- The economic slowdown and recession fears: The pandemic-induced lockdowns and restrictions caused a sharp contraction in economic activity. Many businesses were forced to close, leading to job losses and reduced corporate earnings. This economic slowdown raised fears of a global recession, and investors reacted by selling off stocks to mitigate potential losses.

- Oil price war: Concurrently with the pandemic, a dispute between Saudi Arabia and Russia over oil production levels led to a significant drop in oil prices. The decline in oil prices negatively impacted energy companies, heightened market volatility, and further contributed to the stock market crash.

- Financial market vulnerabilities: Financial markets exhibited signs of exposure before the crash. Excessive speculation, high corporate and government debt levels, and overvalued stocks were prevalent in some sectors. These vulnerabilities made markets more susceptible to shocks, such as the COVID-19 pandemic, and exacerbated the severity of the crash.

- High-frequency and algorithmic trading: The prevalence of high-frequency and algorithmic trading in financial markets can amplify market movements. During periods of extreme volatility, these automated trading systems can exacerbate selling pressure or create rapid price fluctuations, leading to increased market instability and potentially contributing to the severity of the crash.

Examples

Let us understand it in the following ways.

Example #1

In March 2021, Archegos faced significant financial distress and triggered a wave of selling in global stock markets.

Archegos, run by investor Bill Hwang, utilized highly leveraged positions to build large stakes in several companies, primarily through derivative instruments known as total return swaps. When some parts turned against Archegos, they needed help to meet margin calls from their lenders. As a result, their jobs were forcefully liquidated by the banks, leading to substantial selling pressure on the affected stocks.

This event had a cascading effect on various financial institutions involved with Archegos, including global central banks. The sudden liquidation of positions caused significant losses for the banks, with estimates reaching billions of dollars. The incident highlighted the risks associated with excessive leverage, lack of transparency in the derivatives market, and the potential for market disruptions when highly leveraged positions face liquidation.

Example #2

In June 2020, Wirecard filed for insolvency after revealing that €1.9 billion ($2.1 billion) in cash on its balance sheet, supposedly held in trust accounts in Asia, did not exist. The revelation came after allegations of accounting fraud and financial irregularities surfaced, leading to an investigation by authorities.

The collapse of Wirecard had significant repercussions. Investors who held shares in the company faced substantial losses as the stock price plummeted. The incident also raised questions about auditing practices, regulatory oversight, and corporate governance in the financial sector. It highlighted the importance of robust financial controls, independent audits, and transparency in financial reporting.

The Wirecard case prompted discussions about strengthening regulations for fintech companies, improving oversight by financial regulators, and ensuring the integrity of financial reporting. It was a cautionary tale regarding the risks of investing in high-growth, technology-driven companies and the importance of thorough due diligence when evaluating investment opportunities.

Effects

Some acute effects of the 2020 stock market crash are:

- Wealth erosion: The crash resulted in a significant decline in stock prices, leading to a substantial wealth deterioration for individuals and institutional investors. Retirement savings, investment portfolios, and net worth were adversely affected. This loss of wealth directly impacted consumer spending, as individuals became more cautious about their financial situation, leading to a potential decrease in discretionary spending.

- Retirement and financial planning setbacks: The crash disrupted retirement plans for many individuals. Those nearing retirement or relying on their investment portfolios to fund their post-work years faced setbacks. Reduced savings and lower investment returns impacted the ability to meet retirement goals, potentially necessitating adjustments such as delaying retirement, reducing retirement lifestyle expectations, or increasing savings rates.

- Business and corporate impacts: The crash substantially affected enterprises, particularly those with high market exposure or financial vulnerabilities. Companies faced challenges in raising capital, resulting in reduced investment and growth opportunities. As consumer spending declined, industries such as travel, hospitality, and retail were hit hard. This led to bankruptcies, layoffs, and business closures, causing job losses and economic instability.

- Investor sentiment and confidence: The stock market crash shook investors' confidence. The sudden and steep decline in stock prices raised concerns about market volatility and the financial system's stability. Investors became more risk-averse, resulting in decreased investments and a cautious approach toward the market. This sentiment shift had repercussions on investment activities and capital allocation decisions.

- The economic downturn and recessionary pressures: The crash contributed to an economic recession and recessionary pressures. The decline in consumer spending, reduced business investments, and disruptions in various sectors impacted economic growth. Governments and central banks implemented stimulus measures and monetary easing to counter the downturn's effects, but the recovery process varied across countries and industries.

Bailout

Here's an explanation of some associated bailouts of the 2020 stock market crash:

- Corporate Bailouts: Governments implemented measures to provide financial assistance to struggling corporations, particularly in industries severely affected by the market crash. Bailout programs aimed to prevent bankruptcies, protect jobs, and maintain economic stability. These programs often involved direct financial aid, loans, or equity investments in exchange for company ownership stakes. Examples include the CARES Act in the United States, which allocated funds to support industries such as airlines and automakers.

- Central Bank Interventions: Central banks took decisive actions to inject liquidity into the financial system and stabilize markets. They implemented measures such as interest rate cuts and asset purchase programs and expanded quantitative easing. These interventions aimed to support financial institutions, maintain market functioning, and prevent a deeper economic downturn. The Federal Reserve, European Central Bank, and other central banks implemented large-scale monetary stimulus programs to address liquidity concerns and instill market confidence.

- Stimulus Packages: Governments worldwide introduced fiscal stimulus packages to bolster economies and offset the negative impacts of the crash. These packages involved increased government spending, tax relief, and support for individuals, businesses, and healthcare systems. The funds were allocated to unemployment benefits, small business loans, healthcare infrastructure, and research and development for vaccines and treatments. Examples include the U.S. CARES Act and the European Union's Next Generation EU recovery fund.

- Mortgage and Rent Relief: Governments and financial institutions implemented measures to relieve homeowners and renters facing financial difficulties. Programs were introduced to halt foreclosures, suspend evictions, and offer mortgage payment deferrals or loan modifications. Rental assistance programs were also implemented to support individuals and families struggling to pay rent due to job losses or reduced income.

- Sector-Specific Support: Certain industries received targeted support to address their unique challenges. For instance, due to the severe decline in air travel demand, the aviation industry received financial assistance to sustain operations and retain jobs. Similarly, the hospitality and tourism sectors received specific support to mitigate the impact of travel restrictions and reduced consumer spending.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

The experience of individual investors during the 2020 stock market crash varied. Those with well-diversified portfolios and a long-term investment approach may have been better positioned to weather the downturn. However, individual investors who heavily concentrated their investments in a few stocks or affected sectors may have experienced significant losses.

The 2020 stock market crash had mixed effects on cryptocurrencies. Initially, cryptocurrencies, including Bitcoin, experienced a sharp decline along with the broader market. However, as the year progressed, cryptocurrencies saw a surge in popularity and prices, with some viewing them as alternative investments or hedges against traditional markets.

The 2020 stock market crash impacted real estate prices, although it varied by location and market segment. Some areas experienced a slowdown in real estate activity and a temporary price decline due to economic uncertainty and reduced buyer demand. However, low-interest rates and government stimulus measures helped support the real estate market in many regions.