Table Of Contents

What Was The 2008 Financial Crisis?

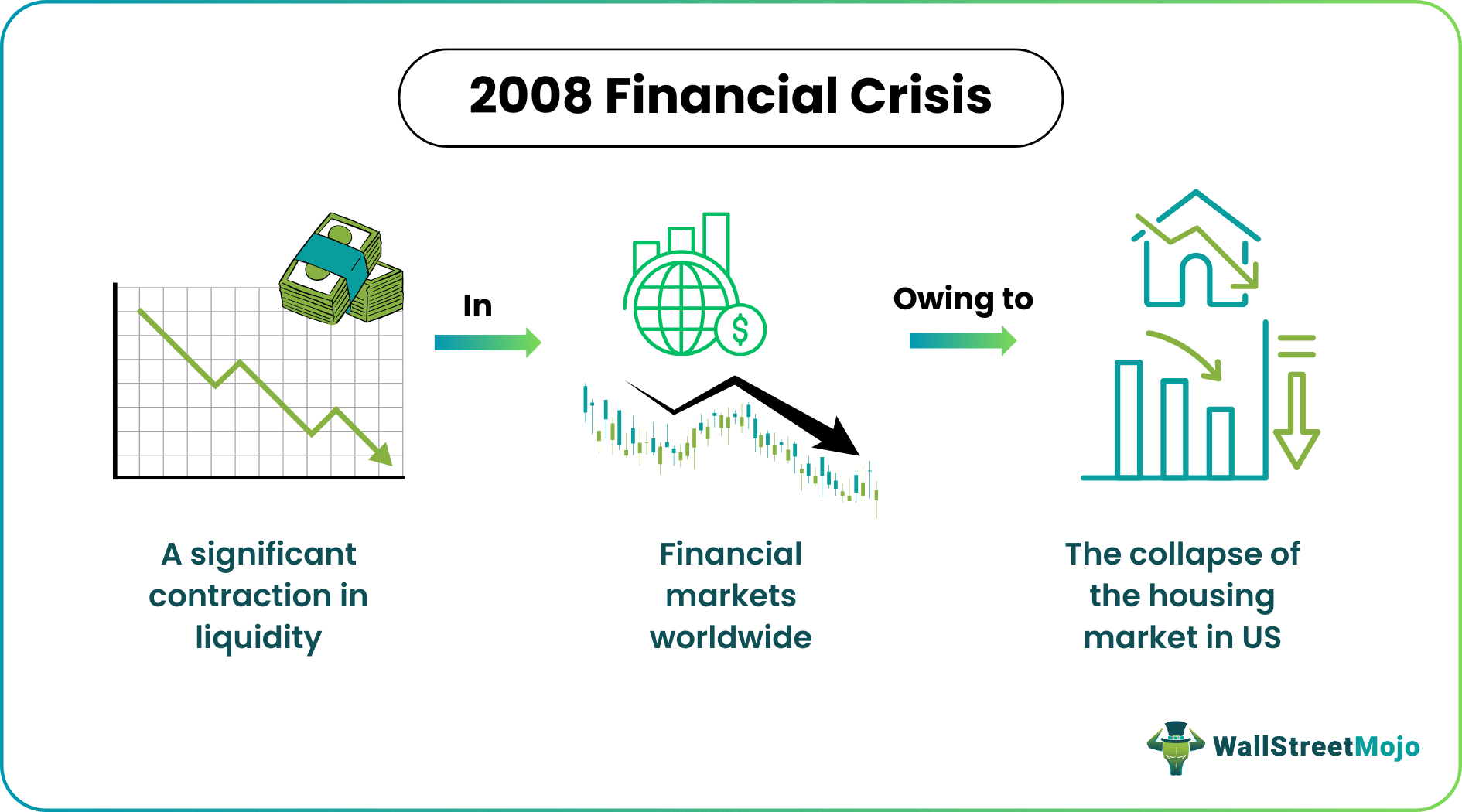

The 2008 financial crisis was a significant and impactful financial crisis faced by the world owing to the U.S. housing market crash. Individuals must know about it in detail to understand its causes, effects, and what not to do to avoid a similar situation again.

On account of this crisis, various financial institutions began to sink. While larger entities absorbed many of them, the federal government had to provide bailouts to keep several organizations afloat. This epic economic and financial collapse cost various individuals their life savings, homes, jobs, and pension. Various factors led to the crisis, and their effects still linger.

Key Takeaways

- The 2008 financial crisis definition refers to a severe liquidity crisis in financial markets worldwide that originated in the U.S. owing to the housing market's collapse.

- The U.S. government passed the American Recovery and Reinvestment Act intending to stimulate economic growth.

- Some major consequences of the 2008 financial crisis were the loss of jobs, savings, and livelihood. In 2010, the unemployment rate was 10% following the crisis.

- During the crisis, many banks failed. The government bailed out multiple financial institutions while larger organizations absorbed others.

2008 Financial Crisis Explained

The 2008 financial crisis definition refers to the most severe economic disaster originating in the U.S., which led to many people losing their livelihoods and homes after the Great Depression of 1929. This epic collapse materialized despite the efforts put in by the United States Department of The Treasury and the Federal Reserve.

This financial crisis triggered the Great Recession, which involved housing prices decreasing significantly more than the price drop during the Great Depression. Even two years after the recession, the unemployment rate in the U.S. was at an all-time high and remained above 9%.

Some of the causes behind this crisis were the loose lending standards and the rock-bottom rates of interest. These two factors combined resulted in a housing price bubble in different countries, including the U.S. In 2003, The Federal Reserve decreased the federal funds rate to boost the economy. This allowed consumers and businesses to avail of funds at a negligible cost of borrowing following multiple corporate scandals, the dot-com bubble burst, and terrorist attacks.

That said, the move led to a rapid increase in home prices as the borrowers tried to make the most of the low cost of borrowing. Even subprime borrowers with poor or no creditworthiness could avail of funds to purchase a house.

In 2007, subprime lenders filed for bankruptcy one after the other. Between February and March, over 25 subprime lenders went out of business. Later, in April, New Century Financial, an institution specializing in subprime lending, laid off its employees and filed for bankruptcy. Moreover, Bear Stearns ceased redemptions in a couple of its hedge funds. This prompted Merrill Lynch to take hold of assets worth $800 million from those funds. Such events were still small compared to what happened later in the following months.

Causes

Housing prices started dropping in 2016 for the first time in many years. Realtors believed that the overheated housing market would come back to a level that is more sustainable. However, they did not consider multiple factors, for example, too many borrowers with questionable credit histories getting mortgage loans and some getting loans exceeding 100% of the home's value.

Indeed, the low-sustained interest rates and the Federal Reserve's expanded credit established an ideal environment for new homebuyers. Nevertheless, an absence of oversight at the two ends of the financial spectrum resulted in substantial defaults.

On the consumer side, predatory lenders targeted low-income individuals who had the prospect of owning their homes via a subprime mortgage, a new mortgage category in the market. Lenders offered such loans to borrowers having poor credit scores.

Moreover, the loan application procedure often did not require a down payment or proof of income. Such loans had adjustable rates that began low but used to jump to a higher interest rate each year or whenever the prevailing interest rates surged.

Subprime mortgages were complex, and lenders did not explain the products well to borrowers. As a result, borrowers did not know what they were choosing. Thus, when the Federal Reserve announced multiple interest rate hikes between 2004 and 2006 to minimize the impact of inflation, millions of borrowers failed to pay their mortgages as they had become significantly more expensive.

Thus, to sum up, the Fed's poor timing with reference to raising and lowering the interest rates, deregulation, and securitization were the main 2008 financial crisis reasons.

The Role Of Banks In 2008 Financial Crisis

Besides making money by earning interest on loans, banks can also generate income through loan securitization, which involves pooling together groups of loans into mortgage-backed securities. A category of MBS called CMOs or Collateralized Mortgage Obligations was further sub-categorized into tranches or slices comprising various subprime mortgages. All slices had their distinct yield and credit rating.

The categories rated 'AAA' were the highest rated. Moreover, they carried the least credit risk as it was deemed that the borrowers could fulfill their financial obligations. The packaged loans with a 'BBB' or lower rating carried higher credit risk, yet they offered the best yields.

The lenders sold the CMOs to investment banks, which viewed such securities as an investment vehicle. They traded the securities globally to generate profits. The primary purchasers of CMOs included money market funds, hedge funds, insurance companies, pension funds, and various other institutional investors.

A few investment banks packaged the AAA and BBB-rated securities together, passing off the bundle as top-rated financial instruments when selling them to investors. All this continued until an asset bubble formed in the U.S. housing market, with speculation leading to a rising in prices ever skyward. The peak of the bubble was in 2006 before it quickly bottomed out.

Timeline

Let us look at a few key events related to the financial crisis of 2007 and 2008.

April 17, 2007: The Federal Reserve Did Not Do Enough To Prevent The Crisis

The Federal Reserve disclosed that it would encourage the financial regulatory agencies to work closely with the lenders to develop loan arrangements in place of foreclosure. The alternatives to loan foreclosure included converting a loan to a fixed mortgage and getting credit counseling via the Center for Foreclosure Solutions.

January 22, 2008: FOMC Reduced The Federal Funds Rate

The FOMC, or Federal Open Market Committee, decreased the Fed funds rate on January 22, 2008, to 3.5%. Then, after a weak, it reduced it to 3%.

February 2008: Home Sales Kept Falling

Home sales in February dropped by 24% on a year-over-year basis to $5.03 million per the National Association of Realtors.

February 13, 2008: Tax Rebate Bill

The U.S. President put his signature on a tax rebate bill to provide support to the nation's struggling housing market.

March 2008

The Federal Reserve started bailouts as the Chair realized aggressive action was necessary to fend off a more severe recession. The aim was to reduce Libor while ensuring the adjustable-rate mortgages were affordable.

March 8, 2008: Term Action Facility or TAF Auction

The Federal Reserve offered $50 billion through its TAF. Its goal was to inject $100 billion into the U.S. economy.

March 11, 2008: Bailing Out The Bond Dealers

On March 11, the Federal Reserve announced that it would offer Treasury notes worth $200 billion to bail out the bond dealers.

March 14: Fed's Emergency Meeting

Three days after an emergency weekend meeting, it publicly announced that it would guarantee the bad loans of Bear Stearns.

March 18, 2008: FOMC Decreased The Federal Funds Rate Once Again

The FOMC lowered the federal funds rate to 2.25%. Since it halved the rate of interest in 6 months, the downward pressure was on the U.S. Dollar, which raised oil prices. Moreover, the federal regulators allowed Fannie Mae and Freddie Mac to avail of subprime mortgage debt worth $200 billion on that day.

April 2008

The Federal Reserve decreased the rate once again and purchased toxic bank debt.

April 7, 2008: Money Added To TAF

The Federal Reserve again started adding to its TAF: On April 7 — $50 billion, and on April 21 — $50 billion.

April 30, 2008: FOMC Decreased The Federal Funds Rate

On the last day of April 2008, the FOMC reduced the federal funds rate to 2%.

May 2008

The Federal Reserve auctioned $150 billion via TAF.

June 2008

By June, the Federal Reserve auctions totaled $1.2 trillion. Moreover, it lent $225 billion via its TAF.

July 2008

The share price of Freddie Mac and Fannie Mae began to fall owing to Wall Street's fears. This made it more challenging for a private company to raise funds independently.

July 11, 2008: IndyMac Bank Failed

IndyMac Bank shut down on July 11, and the FDIC or Federal Deposit Insurance Corporation insured deposits of a maximum of $100,000 only.

July 23, 2008: Paulson Spoke

After making the talk show rounds, Paulson explained the necessity to bail out Freddie Mac and Fannie Mae. These two agencies guaranteed or held nearly half of the nation's mortgages.

July 30, 2008: Housing And Economic Recovery or HERA Act

Congress passed the HERA Act, which gave the U.S. Department of The Treasury the authority to guarantee loans worth $5 billion held by Fannie May and Freddie Mac.

September 2008

In September that year, the U.S. Department of The Treasury bought Fannie Mae and Freddie Mac's preferred stock to keep them afloat.

September 7, 2008: Freddie And Fannie Under Conservatorship

The FHFA, or Federal Housing Finance Agency, placed Fannie Mae and Freddie Mac under conservatorship, allowing the U.S. Government to run them until they became strong enough to come back to independent management.

September 15, 2008: Lehman Brothers Bankruptcy

The bankruptcy of Lehman Brothers severely impacted financial markets, and the Dow dropped 504 points, its worst plunge in the last seven years.

September 16, 2008: The Federal Reserve Bought AIG

The AIG, or American International Group, contacted the Fed for emergency funding. It had mortgages worth trillions of dollars across the world. The FED purchased the company for $85 billion.

September 18, 2008: The U.S. Economy Nearly Collapsed

Investors left the market mutual funds owing to the losses arising from the bankruptcy of Lehmann Brothers.

September 19, 2008: Bernanke And Paulson Met With Congressional Leaders

Bernanke And Paulson met Congress to explain the financial crisis. Bernanke disclosed that the Federal Reserve would offer the funds businesses and banks require to ensure they do not take out funds in money market funds.

September 20, 2008: Treasury Submitted Legislation

Congress submitted a document to Congress seeking the approval of a bailout worth $700 billion.

September 21, 2008: Leading Investment Banks Applied To Become Commercial Banks

Morgan Stanley and Goldman Sachs sought approval to become regular commercial banks.

September 23, 2008: Final Bailout

Congressman Barney Frank and lawmakers negotiated a plan that was cheaper yet offered additional protection to the taxpayers.

September 26, 2008: Washington Mutual Went Bankrupt

The Washington Mutual Bank declared bankruptcy when the financial institution's panicked customers withdrew a total of 16.7 billion within ten days.

September 29, 2008: Stock Market Crash

On account of the rejection of the bailout bill by the House of Representatives, the stock market crashed.

October 2008

Congress passed the bank bailout bill worth $700 billion, enabling the Treasury to purchase shares of the troubled financial institutions.

October 6, 2008: International Stock Markets Collapsed

Stock markets around the world crashed despite the bailout.

October 7, 2008: Commercial Loan Program

The Fed offered short-term loans with interest rates ranging from 2-4% in October.

October 7, 2008: The Central Banks Coordinated Action Worldwide

The Fed and multiple central banks around the world agreed to slash their interest rates by half of a point.

October 14, 2008: Unprecedented Action

The European Union committed to allocate $1.8 trillion in total for guaranteeing bank financing, purchasing shares so that the banks do not fail, and taking the required steps to get the financial institutions to provide loans to each other once again.

October 21: The Federal Reserve Lent $540 Billion

The Fed lent a sum of $540 billion to ensure that money market funds had sufficient cash to meet the various redemptions.

October 29: One More Federal Funds Rate Cut

The FOMC decreased the federal funds rate to 0-0.25, which lowered the discount rate to 0.5%.

November 2008

In November, the Federal Reserve restructured the aid package, decreasing its loan to $60 billion from $85 billion.

November 18, 2008: Chrysler, GM, And Ford Requested Bailouts

Chrysler, Ford, and GM requested bailout funds worth $50 billion. Harry Reid, the Senate Majority Leader, asked the three organizations to come back with a responsible plan.

November 21, 2008: FDIC Guarantee

The FDIC guaranteed loans of up to 1.3 trillion that banks offered each other. Roughly 1.2 million unemployed employees got an additional benefit of 3 months.

November 25, 2008: Treasury Partnership

The U.S. Treasury entered into a partnership with the Fed to utilize a portion of the Troubled Assets Relief Program or TARP for addressing a freeze within the U.S. consumer credit market. The secondary market, worth $1 trillion and comprising student, credit card, and auto loan debt, was at a standstill.

November 26, 2008: More Support For Freddie Mac And Fannie Mae

The Federal Reserve announced its plan to part with $800 billion for purchasing consumer loans and mortgage-backed securities from Freddie and Fannie.

December 2008

In exchange for preferred stock, The U.S. Treasury pumped TARP funds worth $105 billion into eight financial institutions.

Effects

The financial institutions took significant hits when individuals who opted for subprime mortgages defaulted. That said, the government offered bailouts to banks. The crisis severely impacted the housing market in the U.S. Foreclosures and evictions started within months. In response, the stock market crashed, and major businesses around the world shut down, leading to losses worth millions of dollars. This led to widespread layoffs in addition to extended durations of unemployment globally.

A noteworthy consequence of the 2008 financial crisis was the failing confidence concerning financial stability and diminishing credit availability. It resulted in more cautious and fewer investments as international trade slowed down to a crawl. In due course, the U.S. passed the American Recovery and Reinvestment Act in 2009 to respond to this crisis. This federal law involved utilizing an expansionary monetary policy, stimulating economic growth, and facilitating bank mergers and bailouts.

In 2012, the Federal Reserve Bank of St. Louis, Missouri, estimated that American households' net worth dropped by roughly $17 trillion on an inflation-adjusted basis, representing a loss of 26%. Moreover, a study conducted by the San Francisco Federal Reserve Bank revealed that the nation's gross domestic product or GDP 10 years after the crisis was roughly 7% below what would have been if the crisis had not occurred. This represented a $70,000 loss in every American's lifetime income.

Around 7.5 million job losses took place from 2007-2009, marking a doubling of the rate of unemployment, which was almost 10% in 2009. Although the U.S. economy gradually added jobs following the beginning of the recovery, a lot of those jobs were less secure and lower paying than the ones lost.

2008 Financial Crisis vs Great Depression

One new to the finance world might think that the 2008 financial crisis and the great depression are the same. However, these two crises are different events with distinct characteristics. The table below can help us know how they differ.

| 2008 Financial Crisis | Great Depression |

|---|---|

| The main 2008 financial crisis reasons were deregulation, securitization, and the lowering of interest rates, leading to the bursting of the U.S. housing market bubble. | This economic crisis occurred due to the stock market crash in 1929 and the tight monetary policies that the Central Bank of America adopted. |

| The crisis occurred between 2007 and 2009 | It took place from 1929-1933. |

| The peak of unemployment was 10% in the U.S. in October 2009. | In 1933, the peak of unemployment was 25%, owing to the Great Depression. |

| During this crisis, the Federal Reserve reduced interest rates and increased the liquidity in the economy. | The Federal Reserve raised interest rates to limit speculation within the securities market. |

Frequently Asked Questions (FAQs)

In September 2008, Congress gave approval for the 'Bailout Bill' that offered $700 billion for adding emergency liquidity to the market. It helped solve the financial crisis in the U.S.

The chief executive officers of firms that played a direct role in fanning the Great Recession's flames generated handsome profits during the crisis. They were as follows:

- John Paulson

- Warren Buffet

- Ben Bernanke

- Carl Icahn

- Jamie Dimon

The Bush administration could have taken measures to reduce the outsized fiscal deposits that stimulated foreign borrowing, and it should have taken necessary steps to slow down an overheated economy. Moreover, The Fed could have increased lending rates to put the brakes on the credit boom.

The crisis taught investors many things. However, some noteworthy lessons are as follows:

- Portfolio diversification is vital

- One should look for indicators of economic stress and slowdowns

- Patience is a key factor

- One must look beyond the equity market