Table Of Contents

What are Anchoring and Adjustment?

Anchoring and adjustment refer to the cognitive bias whereby a person is heavily dependent on the information received initially (referred to as the “anchor”) while making subsequent decisions. In other words, all the following choices are influenced and require adjustments to remain close to the initial anchor value, which can cause a problem if the anchor is too different from the true value. Typically, this bias is seen when individuals build future outcomes based on available information.

Key Takeaways

- Anchoring and adjustment are related to a cognitive bias in which a person's decision-making is heavily influenced by the information they first gathered.

- In other words, if the anchor is too far from the actual value, all the following options will be impacted and require modifications to keep near the initial anchor value. This bias may be seen when people base their predictions of future outcomes on readily available data.

- The anchoring and adjustment effect can be connected through suggestion and subliminal anchoring.

- If an analyst uses an economic forecasting or pricing model, one can observe financial anchoring and adjustment.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Explanation

A person exhibits anchoring and adjustment behavior during decision-making when the initial set of information heavily influences all their decisions.

Typically, the individual would tend to integrate all those ideas that fall within the acceptable range of the anchor and reject those that are not in line with the anchor. So, only those values are discussed close to the anchor in all genuine arguments, negotiations, estimates, etc. The underlying principle of anchoring and adjustment is that an individual chooses a particular value or number as the starting point (a.k.a. the anchor), eventually becoming the target number. Subsequently, the individual adjusts the following information until it reaches within an acceptable range of the target value over the period.

Video Explanation of Anchoring and Adjustment

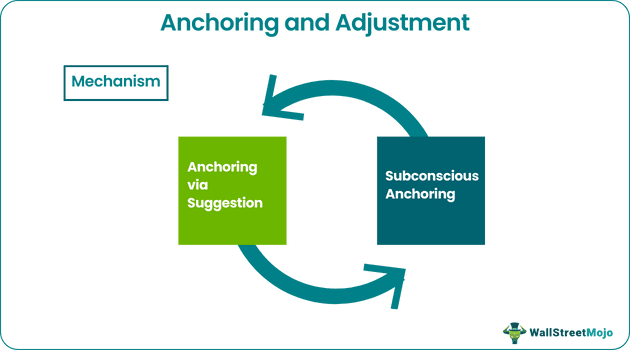

Mechanism

As already discussed above, anchoring is a cognitive bias wherein an individual relies too much on facts before decision-making to help the process. There are instances when the facts provided are entirely useless or even absurd. Nevertheless, research stats indicate that these initial sets of information significantly impact decision-making irrespective of their relevance to the subject matter. While anchoring is believed to be a semiconscious or subconscious phenomenon, adjustment to the anchor is a conscious decision.

The underlying mechanism that drives the anchoring and adjustment effect can be linked to the following two concepts: -

- Anchoring via Suggestion: The initial set of information can be compared to a suggestion in this type of anchoring. Once a recommendation is made based on some association, it becomes the basis for all estimations that follow, and adjustments are made based on the same. It forms the basis of semiconscious anchoring.

- Subconscious Anchoring: IIn this type of anchoring, an individual has little to no association with the anchor. At times these anchors are incorrect. In this case, the person believes that the anchor is correct or, at times, acknowledges that it might be mistaken but believes it is still worth it to stick to the anchor. Eventually, the individual makes all the adjustments to hold on to the anchor.

Anchoring and Adjustment Examples

- Example #1 - Let us take the example of a used car salesman to illustrate the concept of anchoring and adjustment. Usually, the salesman would quote a very high price to start the negotiations, which is undoubtedly well above the car’s market value. Now, the initial price quoted by the salesman becomes the anchor, and as such, the buyer invariably would end up paying a final price much higher than the fair value. The car salesman only made it possible by creating an anchor with a higher quote.

- Example #2 - Let us take another example of a hiring manager to illustrate the concept of anchoring and adjustment. During negotiations, a hiring manager might consider offering a very low compensation package to a prospective candidate. Now, because of the lower starting point, the candidate might join at a relatively lower initial salary even after several rounds of negotiation.

Anchoring and Adjustment Heuristic in Finance

In finance, one can see anchoring and adjustment when an analyst builds an economic forecasting tool or a pricing model. The cognitive bias creeps in when an analyst creates financial models based on a big idea that fails to consider many other related and relevant factors. The best modus operandi to mitigate the risk of anchoring is to assimilate the approaches of multiple models.

According to Phillip Tetlock, a social psychology researcher, the forecasters who make predictions based on multiple ideas or perspectives can build better forecasting models than those who emphasize a single model. In short, an analyst can make his work less vulnerable to anchoring effects by incorporating the best of different models and forecasts into their model.

Disadvantages

- If the initial anchor value is not adjacent to the true value, all subsequent adjustments to bias towards the anchor value will take the outcome away from the true value.

- At times, the anchor value is different from the true value. In such cases, an individual might struggle to draw connections between the irrelevant initial information and the true value.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

Anchoring and adjustment is an understandable inquiry where a person starts firstly with an idea and adjusts their beliefs depending on this starting point. However, it has been shown to generate incorrect results if the initial anchor varies from the actual value.

Investors are affected by anchoring and adjustment bias, which causes them to view new information critically. As a result, they should have emphasized anchor points that were chosen arbitrarily by statistics and psychology. A prevalent bias that can be used in business decision-making and other areas of finance is anchoring.

Anchoring and adjustment bias can lead individuals to rely too heavily on an initial piece of information. , which leads to biased judgments and decisions. People tend to anchor their subsequent estimates or judgments around the initial anchor.